Community Person of the Year

Boys & Girls Clubs of Metro Louisiana

NEW ORLEANS/LOS ANGELES, September 6, 2023 — Chad Brownstein has been named inaugural Community Person of the Year for Boys & Girls Clubs of Metro Louisiana. Mr. Brownstein was awarded the prestigious honor for his generous dedication of time and resources to philanthropic efforts directed to support at-risk youth.

“Mr. Brownstein has continued to show extraordinary dedication towards our programs and members. We are so pleased to honor and recognize him with the inaugural Community Person of the Year award,” said Boys & Girls Clubs of Metro Louisiana Chief Development Officer Emily Sparks.

Mr. Brownstein has committed to match contributions up to $100,000 for an online fundraiser challenge shared equally between Boys & Girls Clubs of Metro Louisiana and Boys & Girls Clubs of Metro Los Angeles, 100% of all contributions will go directly to the Clubs. The fundraiser will be hosted on Zoom on Nov. 1 at 1:00 p.m. PST.

Mr. Brownstein has been a loyal partner of Boys & Girls Clubs of Metro Louisiana for multiple years. In 2023, he selected the organization to be the charitable beneficiary of the Tulane Women’s Golf Classic presented by Chad Brownstein which provided $25,000 for educational supplies to support their New Orleans Club location. An additional $20,000 was contributed at the event by charitable families from Los Angeles.

In 2023, Chad was inducted into the Jeremiah Milbank Giving Society for his contributions to the organization.

“Boys & Girls Clubs of America is a special national organization supporting at-risk youth. The Brownstein family has seen firsthand how BGC changes the lives of young people. I am proud to accept this honor and look forward to continuing the support of nation’s underprivileged youth,” said Mr. Brownstein.

Those wanting to make a donation can do so at: https://secure.givelively.org/donate/boys-girls-clubs-of-metro-louisiana-inc/chad-brownstein-s-fundraiser-for-boys-girls-clubs

To support the fundraiser on Nov. 1, join the Zoom meeting at: https://us06web.zoom.us/j/88538194434?pwd=cmc1R3FNVkZqRVE1bGswTktpeUdSUT09

###

About Boys & Girls Clubs of Metro Louisiana

Boys & Girls Clubs of Metro Louisiana serves youth ages 6-18 in nine Club locations in Baton Rouge, Covington, Gretna, New Orleans and Slidell through after-school and summer programming that emphasizes academic success, healthy lifestyles and character and leadership. Their mission is to enable all young people, especially those who need us most, to reach their full potential as productive, caring, responsible citizens. For more information, please visit our website at www.bgcmetrolouisiana.org

About Boys & Girls Clubs of Metro Los Angeles

The mission of the Boys and Girls Clubs of Metro Los Angeles (BGCMLA) Our mission is to create a safe space to empower all Club members to learn, explore, achieve, and dream (L.E.A.D)! Committed to sustainable impact, BGCMLA is the result of a partnership unifying Los Angeles’ Boys & Girls Clubs that have been serving thousands of youth in the region’s most vulnerable neighborhoods since 1960 including Challengers, Venice, Watts/Willowbrook, Bell Gardens Club sites, and in recent years several school sites. BGCMLA offers nationally recognized programs in three core areas to ensure the achievement and empowerment of youth and their families: Academic Success, Good Character and Citizenship and Healthy Lifestyles. For more information, please visit our website at www.bgcmla.org

Contact: Lauren McKinney, Boys & Girls Clubs of Metro Louisiana

Email: lauren@bgcmetrolouisiana.org

Contact: Brittany Bell, Boys & Girls Clubs of Los Angeles

Email: britt@theconsultingqueen.com

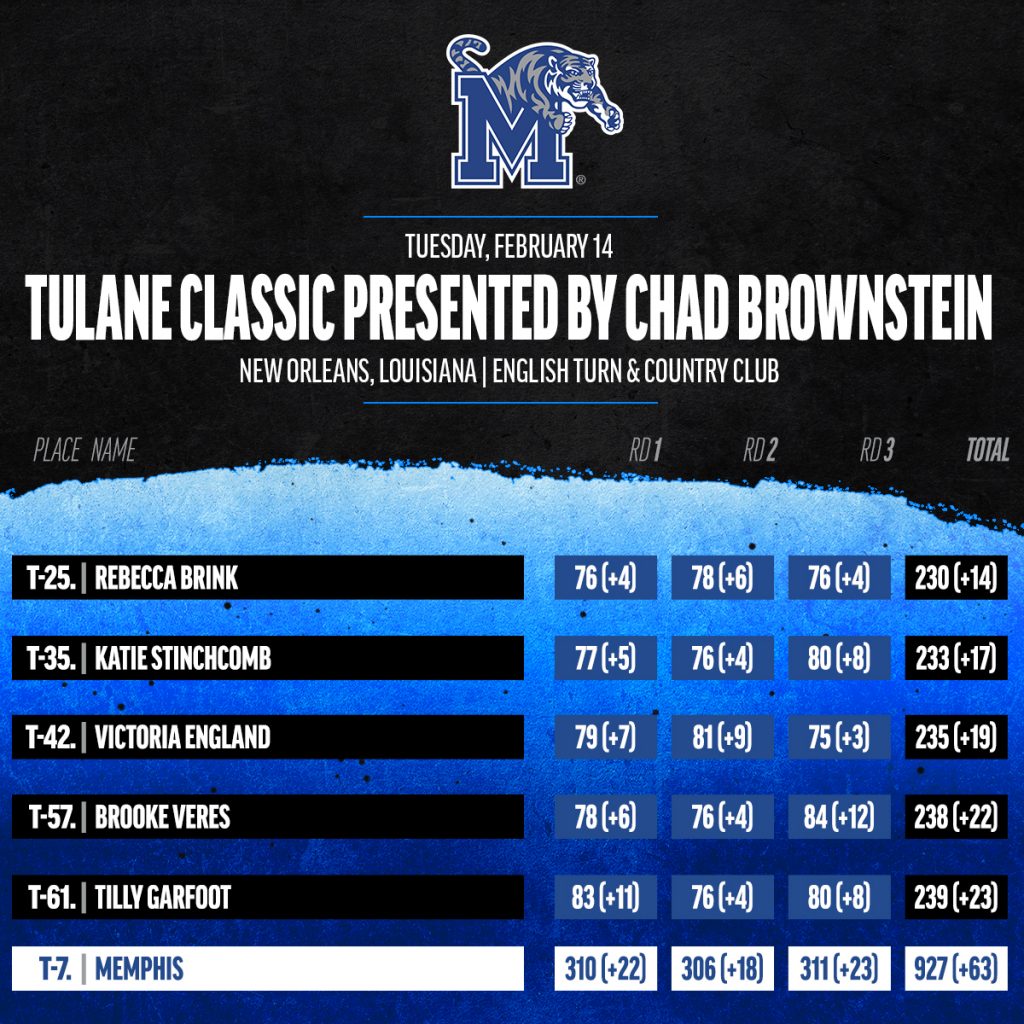

The Chattanooga Mocs moved on moving day at the Tulane Classic presented by Chad Brownstein. On the first day of the tournament, the Mocs took the team up to 12th at 625. That was six strokes behind 10th-place duo Boston College and Cal Poly, while sitting two better than Arkansas State and Howard in a tie for 13th.

The Chattanooga Mocs moved on moving day at the Tulane Classic presented by Chad Brownstein. On the first day of the tournament, the Mocs took the team up to 12th at 625. That was six strokes behind 10th-place duo Boston College and Cal Poly, while sitting two better than Arkansas State and Howard in a tie for 13th.